When I sit down with a new client or prospect, one of the first topics we discuss is budgeting. For existing clients, I usually revisit this after the holidays or in January.

I believe the way we consume and purchase goods now makes it harder to track our budget, mainly because it is so easy to spend money now. You don’t even need to reach for your card or pay with cash in many instances. You can pay with your phone at the checkout counter or save your preferred payment method on a retailer’s website to expedite the process.

The speed with which you can purchase increases the likelihood of making mistakes (I myself am guilty of ordering things online and shipping them to an old address). Actions like this can wreak havoc on our budgets and our finances.

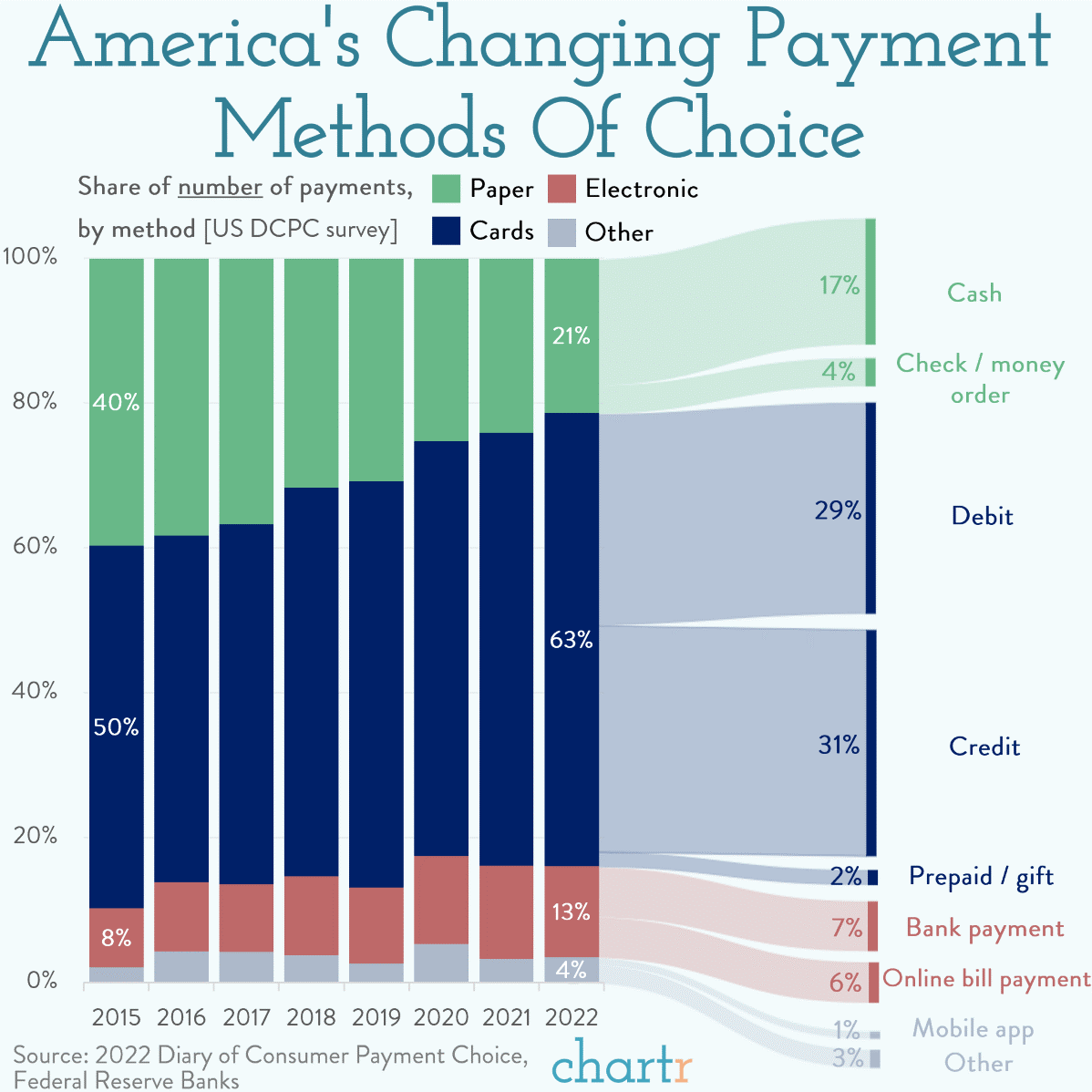

The share of plastic payments is up 13% in the last 7 years, with the majority coming from people paying with credit cards, sending total credit card debt soaring above the $1 trillion mark for the first time ever in 2023.

The share of plastic payments is up 13% in the last 7 years, with the majority coming from people paying with credit cards, sending total credit card debt soaring above the $1 trillion mark for the first time ever in 2023.

At the same time, the share of older Americans with debt has been increasing in recent decades, growing from around 40 percent in 1989 to more than 60 percent in 20191. What’s particularly alarming is the amount of growth in unsecured debt, 85% of which consists of credit cards. This has been exasperated over the past several years with the precipitous rise in interest rates, which makes holding this kind of debt even more detrimental.

Here are some rules of thumb to determine if you currently hold too much debt:

If your debt exceeds these levels, here are some techniques that can help you manage your debt:

If you’d like to discuss any of the strategies above or work with someone to get back on track, feel free to reach out to your Sentinel financial planner.

This website uses cookies. By accepting the use of cookies, this message will close and you will receive the optimal website experience. For more information on our cookie policy, please visit our Privacy Policy.